Diocese of London - Non-Operational Property Portfolio

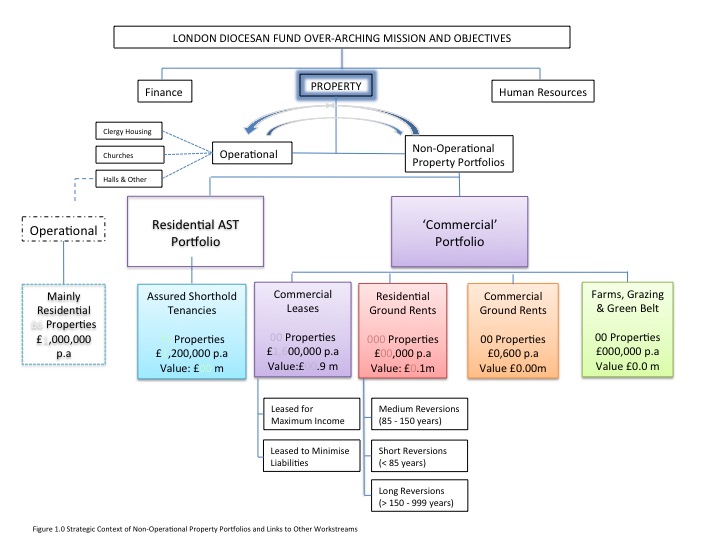

The Diocese owns a portfolio of over 200 'non-operational' properties, of varying types and mainly located in London. The portfolio was passively managed and the Diocese wished to explore ways of making it contribute more effectively to the wider mission. Will was appointed as a consultant to work in-house, alongside the Diocese's staff and advisors to help formulate a strategy for the portfolio.

The first challenge was to get a better understanding of what was owned. Assembling the data took time, but once accomplished it was possible to classify the assets into categories and apply strategic thought to what could be done within each category.

Complexity distilled into simplicity

Office building lease re-gear

A complex portfolio was distilled down into logical groupings with strategies applied right down to an individual property level.

As a result of this work, the Diocese had a much clearer idea of what it owned and numerous opportunities were identified for adding value either by redevelopment, sale or change of use. A new management structure was also instigated so the DoL could start to shape the portfolio in a more proactive way to ensure that it was truly supporting the wider mission.

Family Property Company - East Midlands

Property company formed from the residual real estate left after the sale of the family bakery business. The portfolio comprised mainly residential properties that had been passively managed and were generally in poor condiiton. Many properties were vacant, although some were let on Assured Shorthold tenancies.

Working with the Directors, Will undertook a strategic review looking at the options, which ranged from doing nothing through to selling out immediatley. A decision was taken to hold the properties and move from a passive to an active management positon. The company looked to improve the existing properties and to expand the portfolio, including acquiring commercial properties.

Will was appointed as a Director and worked with fellow Directors to deliver on the plan. The portfolio is now 100% let and two commercial premises have been acquired. One was refurbished and sold at a profit. Shareholders funds have increased from £1.8m in 2008 to £2.9m in 2016.

Girlguiding UK

Girlguiding UK were looking at opportunities to generate income and/or capital from their headquarters estate. Working with Gerald Eve LLP, Will undertook a strategic review of Girlguiding UK's training and activity centres and their headquarters estate. This identified considerable under-utilised space at their premises in Victoria, London.

The offices were re-modelled releasing half of the space to the rear for refurbishment and rental to a hotel operator. This is now generating over £1 million per annum towards Girlguiding UK's mission.